H&r Block Academy Quiz 1 Answers

~ hopefully this post provides the answer you need for basic tax questions. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

Quiz 1 Ch 1-6docx - Hr Block Income Tax Course Quiz1 Ch1-6 1 Which Of The Following Best Describes Gross Income A All Income From Whatever Source Course Hero

Also you can find daily deals, sales and offers.

H&r block academy quiz 1 answers. Here is the h&r block budget challenge week 1 quiz answers. I was offered a contingent position, depending on the passing of the tax course. Happiness rating is 78 out of 100.

The student had not completed the first four years of postsecondary education before 2011; Dec 26, 2017 · after preparing your own taxes, gain peace of mind knowing that an h&r block tax expert has reviewed, corrected, signed and filed your tax return on your behalf. 4.1 out of 5 stars.

You need to past an exam. [download] h & r block tax assessment test questions. 57 people used view all course ››

Just go to your nearest h&r block and they will be happy to help you. Generally, it must be filed within 3 years from when the original return was filed, or two years from when the taxes from when the taxes were paid. The tutor can help you get an a on your homework or ace your next test.

If a person wants to pass the h and r block tax assessment, it is necessary to study. Get weekly updates, new jobs, and reviews. Contact their employer to receive a corrected w line 24a on a, 40a on no, some exemptions apply.

Her only asset was death. (16.17) flashcards for the final test in the h&r block course. Contact their employer to receive a corrected w line 24a on a, 40a on no, some exemptions apply.

View ethicstest1pg_h&r block.pdf from acct 10 at pasadena city college. H&r block interview questions & tips. We are on our 3rd week and to be fair i already had some previous knowledge of taxes but have never taken a course until now.

The student has not claimed an aoc in any four earlier tax years; The student had not been convicted of any federal or state felony for possessing or distributing a. H&r block tax specialist 1 exam answers.

H r block assessment quiz answers. The exam is kind of challenging for those. Write down the unique ein that will be generated by the software.

I paid $199, however, it costs more at class locations in larger cities ($299 to $399). To search for available courses as a guest, click on the browse catalog link on the left.; At this page, there are coupon codes, promo codes and discount coupons.

Passenger automobiles weighing 6,000 lbs or less. If an axception applies, a code is entered in form line 2. The in june 2016, cynthia died.

12 tips to save time &am. A tax return or claim for refund requiring a paid tax requiring a paid tax return preparer to determine eligibility for eitc, ctc/odc/actc, and the head of household filing status may be subject to a maximum penalty totaling what amount for failure to meet due diligence requirements if all four are claimed on a. H&r block income tax course quiz #3 ch.

H&r block most certainly does tax refunds with the last paycheck stub h & r block assessment test answers. Property used for entertainment, recreation, or amusement. For returning itc/tka guest users, enter your username and password in the fields to the left.

This is just a taster to get you warmed up. Tell me more about what you need help with so we can help you best. Generally, it must be filed within 3 years from when the original return was filed, or two years from when the taxes from.

H&r block interview questions & answers | indeed.com. H&r block is one of the bigger and more prestigious tax agencies but there are better tax preperation service out there that can offer a lower cost too h & r block assessment test. There are many things to know about taxes and how to prepare them, so studying.

H&r block is an american tax preparation company operating in north america, australia, and india. If you are a new to this site, and are interested in taking the h&r block income tax course or the tax knowledge assessment, click on the register here link on the left to register and create an account.; [free] h&r block tax specialist 1 exam answers.

H&r block 2021 (tax year 2020): She lived home with her sister roxanne until the time of her death. Computer and related peripheral kequipment.

If an axception applies, a code is entered in form line 2. H&r block answers to the final exam Cell phones and other communication equipment.

I am currently taking the 2014 h&r block tax course in california.

Hr Block Income Tax Course Is It Worth It - Single Income Dual Cats

Quiz 1 Ch 1-6docx - Hr Block Income Tax Course Quiz1 Ch1-6 1 Which Of The Following Best Describes Gross Income A All Income From Whatever Source Course Hero

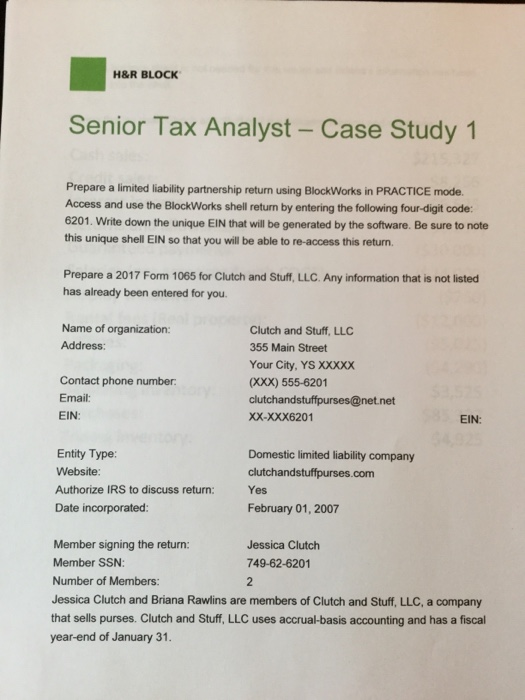

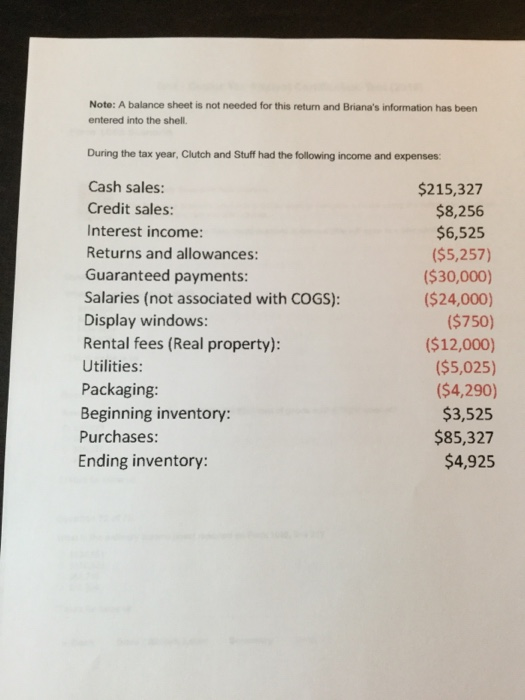

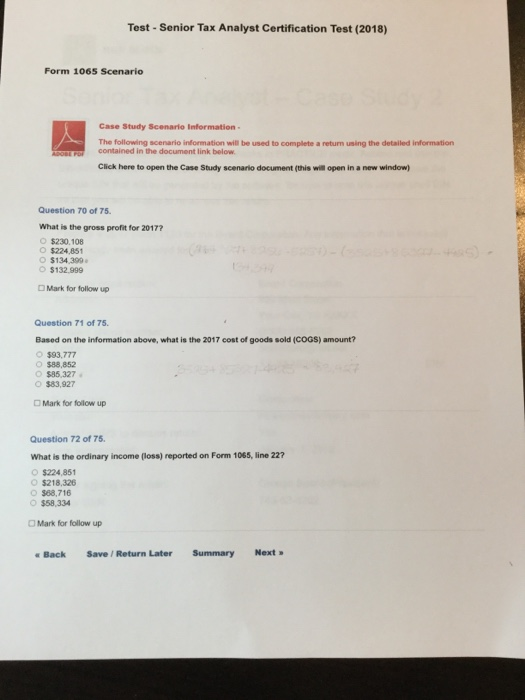

Solved Hr Block Senior Tax Analyst - Case Study 1 Prepare A Cheggcom

Quiz 1 Ch 1-6docx - Hr Block Income Tax Course Quiz1 Ch1-6 1 Which Of The Following Best Describes Gross Income A All Income From Whatever Source Course Hero

Solved Hr Block Senior Tax Analyst - Case Study 1 Prepare A Cheggcom

Quiz 1 Ch 1-6docx - Hr Block Income Tax Course Quiz1 Ch1-6 1 Which Of The Following Best Describes Gross Income A All Income From Whatever Source Course Hero

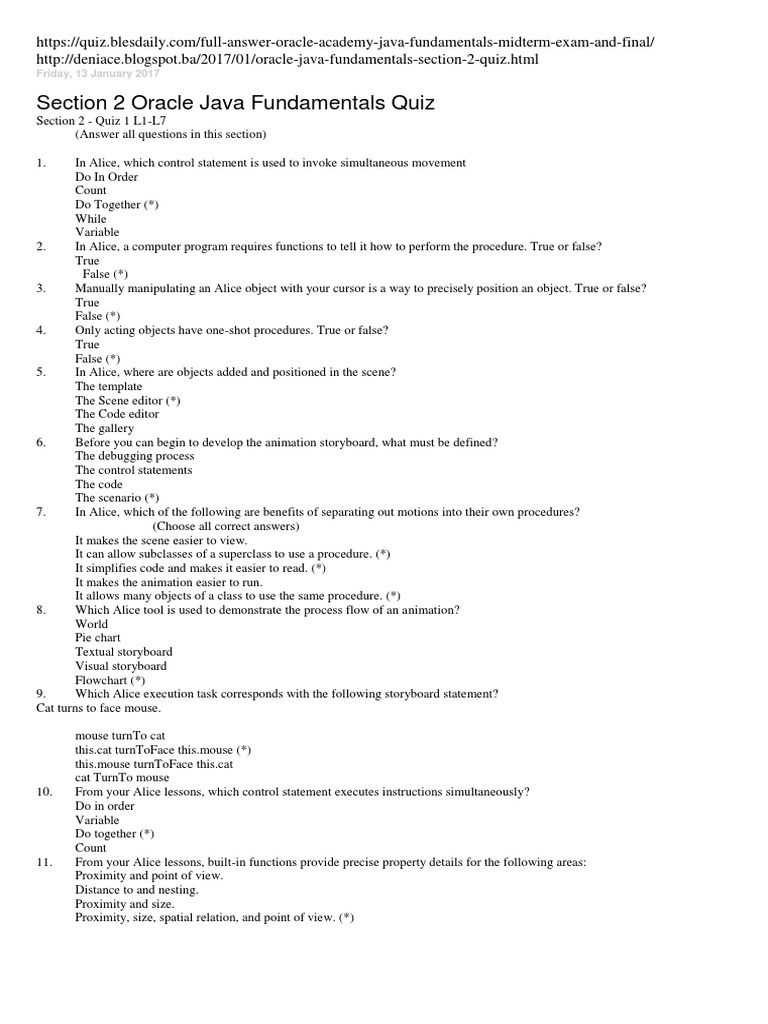

Quiz 1 Section 2 Pdf Control Flow Inheritance Object Oriented Programming

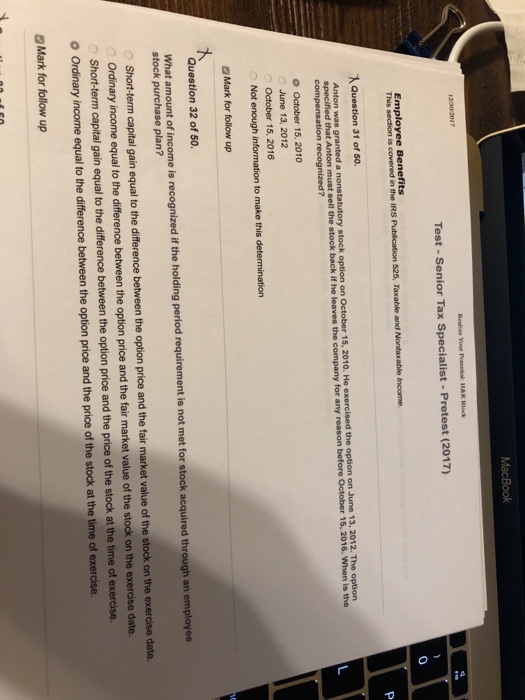

Macbook Realize Your Pobential Hr Block Test - Cheggcom

H R Block Tax Knowledge Assessment Answers - Tax Walls

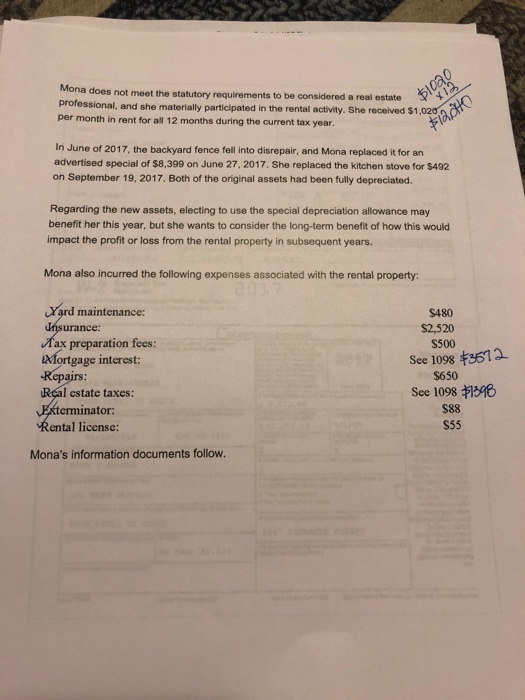

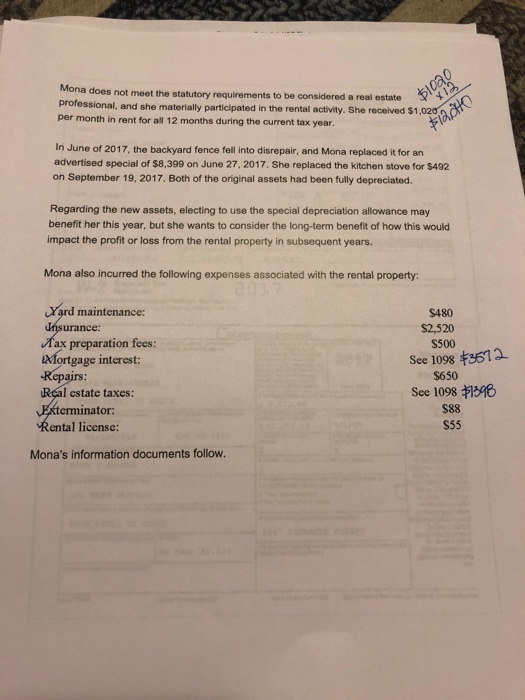

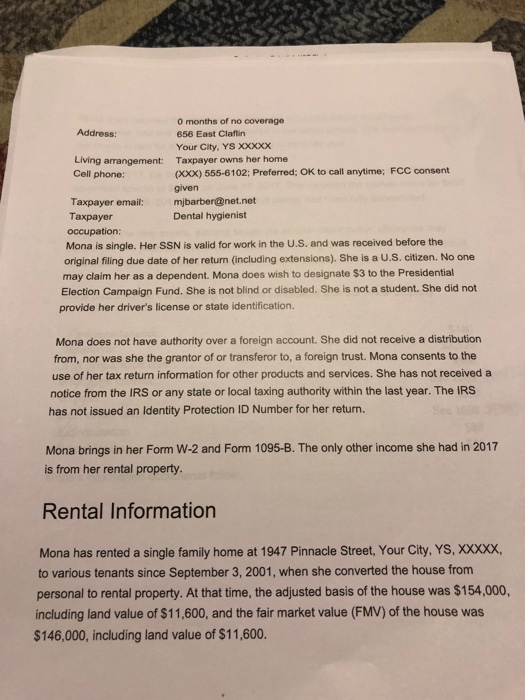

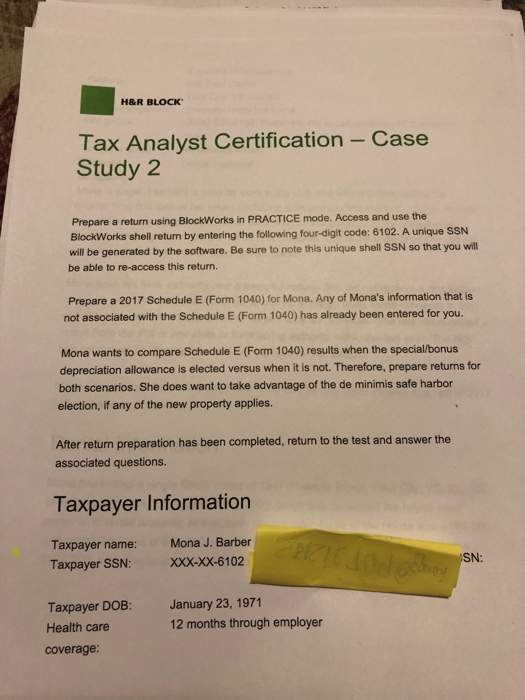

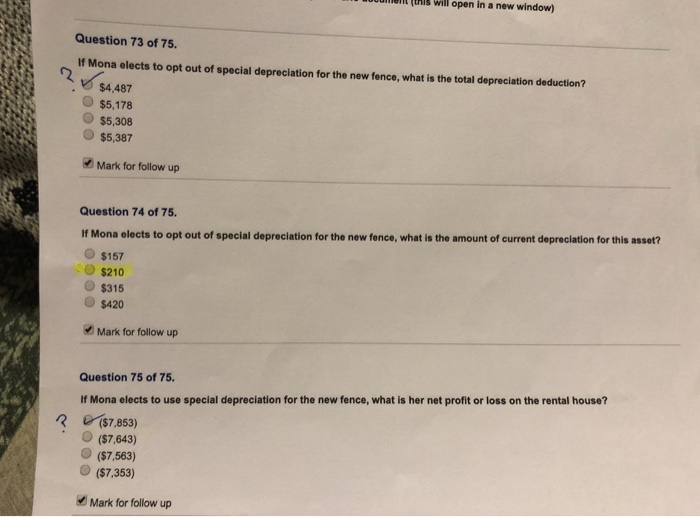

Solved Hr Block Tax Analyst Certification - Case Study 2 Cheggcom

Quiz 1 Ch 1-6docx - Hr Block Income Tax Course Quiz1 Ch1-6 1 Which Of The Following Best Describes Gross Income A All Income From Whatever Source Course Hero

Quiz 1 Ch 1-6docx - Hr Block Income Tax Course Quiz1 Ch1-6 1 Which Of The Following Best Describes Gross Income A All Income From Whatever Source Course Hero

Solved Hr Block Tax Analyst Certification - Case Study 2 Cheggcom

Quiz 1 Ch 1-6docx - Hr Block Income Tax Course Quiz1 Ch1-6 1 Which Of The Following Best Describes Gross Income A All Income From Whatever Source Course Hero

Solved Hr Block Tax Analyst Certification - Case Study 2 Cheggcom

H R Block Tax Knowledge Assessment Answers - Tax Walls

Solved Hr Block Senior Tax Analyst - Case Study 1 Prepare A Cheggcom

Quiz 1 Ch 1-6docx - Hr Block Income Tax Course Quiz1 Ch1-6 1 Which Of The Following Best Describes Gross Income A All Income From Whatever Source Course Hero

Hr Block Tax Knowledge Assessment - Knowledgewalls